An interesting report from Omdia regarding ” Market Landscape: RAN Vendors 2024 “

The report is only for RAN Hardware and Software for macro base stations and small cells. Open RAN and vRAN are considered under the portfolio dimension, but they have no impact on the business performance dimension.

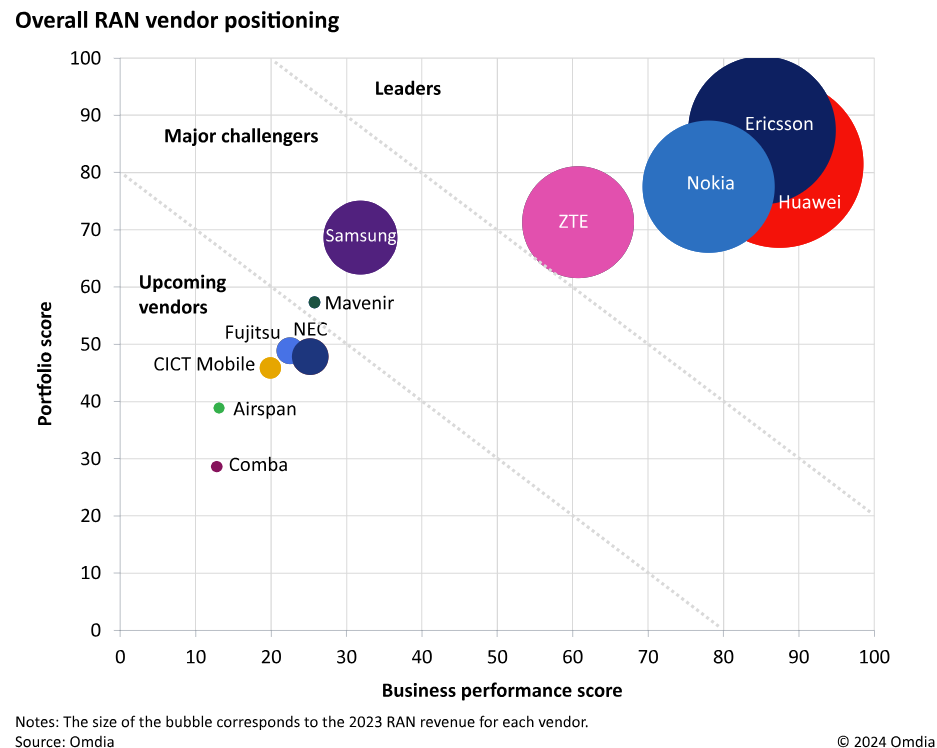

Omdia does not suggest that open RAN or vRAN solutions are better or worse than integrated purpose-built RAN solutions. It selected two main dimensions for this evaluation: RAN business performance and RAN portfolio breadth and competitiveness.

- Ericsson is the leader in the portfolio dimension and second to Huawei in business performance. Ericsson is strong across all categories, and its key strengths include its radio portfolio breadth, massive MIMO (mMIMO) products, and baseband units’ power efficiency.

- Huawei is the leader in business performance thanks to its high revenue market share and number of deals, and it is the runner-up in the portfolio dimension. Huawei’s strengths include its radio portfolio breadth, massive MIMO products, and baseband units’ capacity.

- Nokia ranks third in the two dimensions, Nokia’s portfolio of RAN solutions has no weaknesses, but it is less extensive than the portfolios of the other two leaders. Baseband is one of the vendor’s key strengths.

- ZTE Corporation entered the leaders’ territory in 2023 and continued strengthening its position, particularly on the business performance dimension, thanks to market share gains and new deals in 2023.

- Samsung Networks is the leader in open vRAN. however, its portfolio is less extensive than the leaders’.

- Mavenir did not participate in the 2023 market landscape report but entered as a major challenger in 2024. However, it has a competitive portfolio centered on O-RAN solutions and the richest partner ecosystem.

Also, the report covers other vendors like NEC Corporation, Fujitsu, Airspan Networks, and Comba Telecom that play an important role in Open_vRAN projects and the Baseband portfolio.