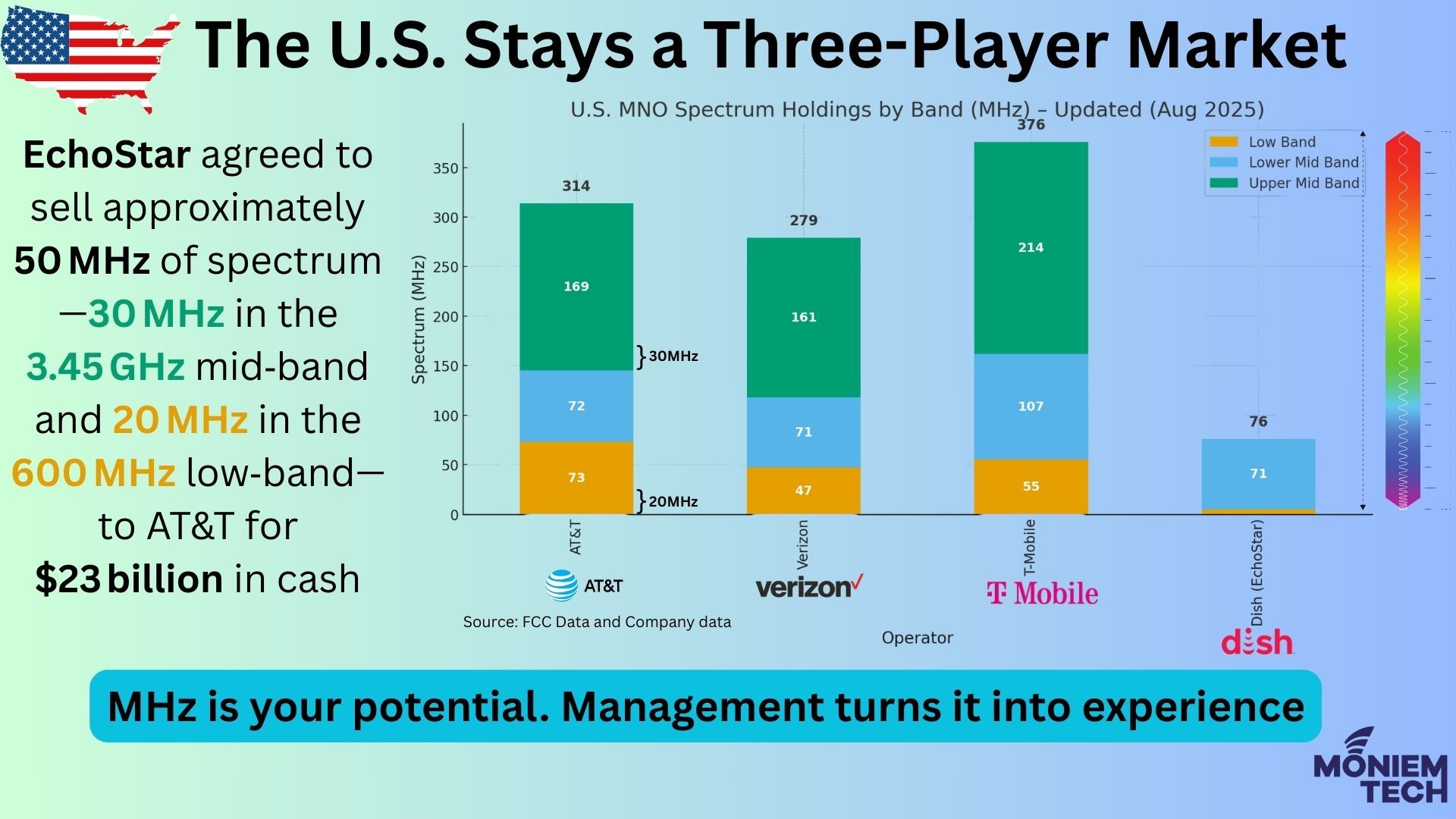

For many years, policymakers, regulators, and industry observers maintained expectations for a fourth national wireless carrier to contend with AT&T, Verizon, and T-Mobile. This anticipation primarily relied on DISH Network, which was subsequently merged into EchoStar, and had compiled an extensive spectrum portfolio, committing to developing a competitive 5G network.

DISH has invested over $30 billion in spectrum over the last decade, becoming the FCC-backed “fourth carrier.” In 2020, it committed to deploying a nationwide 5G network that would cover 70% of the population by mid-2023. However, despite initial progress with a cloud-native, OpenRAN-based build, DISH faced challenges such as capital expenditure constraints, vendor issues, and high costs associated with scaling. By 2025, due to debt, FCC scrutiny, and slow adoption, DISH (through EchoStar) sold key mid- and low-band assets to AT&T.

But with the $23B sale of 50 MHz of spectrum to AT&T in 2025, DISH’s ambitions as a facilities-based operator are officially over. The U.S. market is consolidating around the Big Three, and the competitive landscape looks more settled than ever.

DISH transitions from a would-be operator to a hybrid MNO, focusing on Boost Mobile customers who will now ride primarily on AT&T’s infrastructure. Unfortunately, it’s a negative for the vendors involved in powering the Boost RAN network, including Samsung, Mavenir and a host of other players.

Conclusion

DISH’s collapse isn’t just the story of one company overreaching — it’s a broader lesson about the structural economics of the U.S. wireless market. Building and sustaining a nationwide network requires scale, capital, and execution that even spectrum-rich challengers cannot easily muster.

The U.S. has, once again, confirmed its reality: a three-player market, with no fourth on the horizon.